Trending

Stay up to date on what’s new in work benefits, employee life and wellness, and communications.

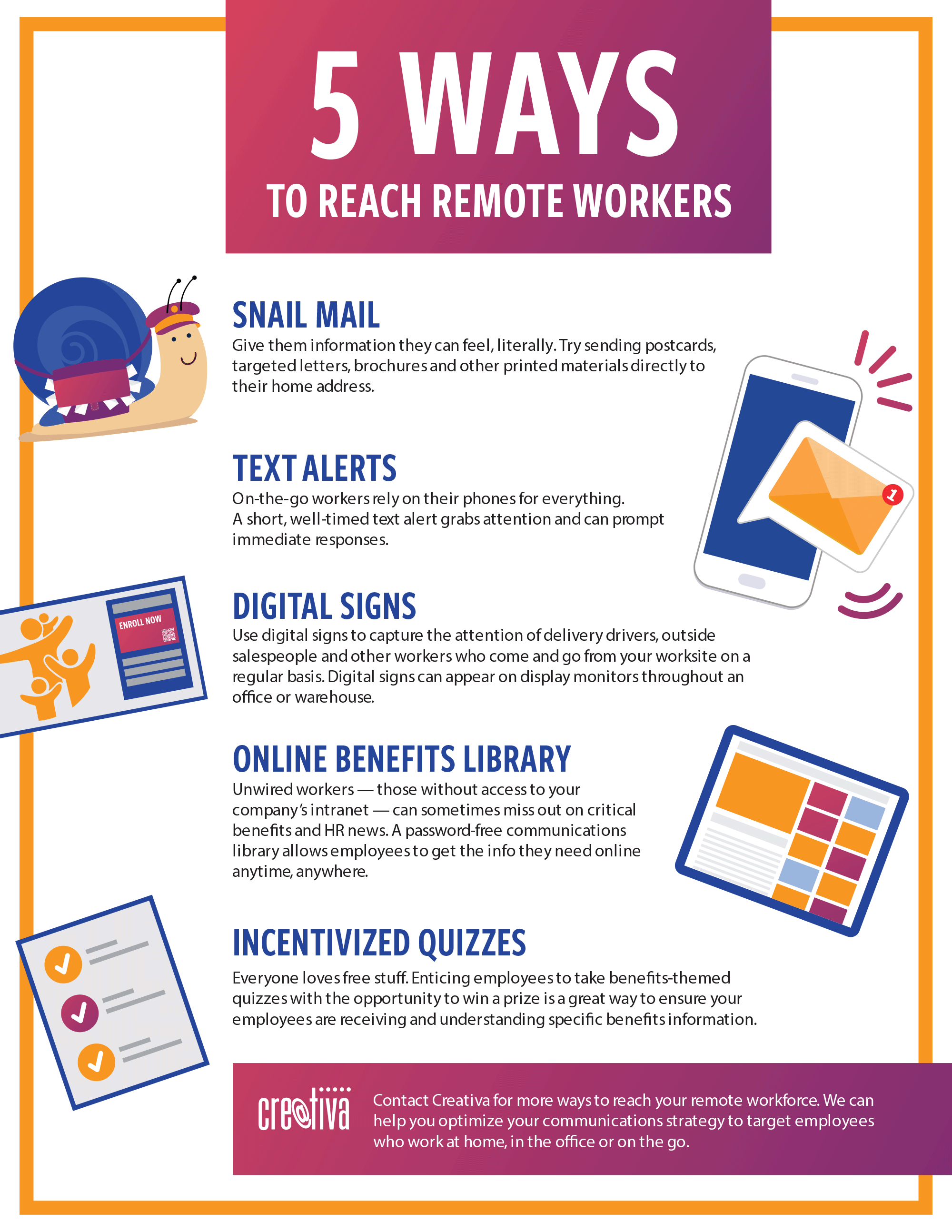

5 Ways to Reach Remote Workers

The Ins and Outs of Health Savings Accounts

Many people can open a health savings account (HSA) through a work medical plan that’s also a high deductible health plan. However, employees often confuse the HSA with a health care flexible spending account (FSA) and are unsure of how to use their account. Here are a few HSA pointers.

- Save, save, save. An HSA is a SAVINGS account as its name makes plain. Employees should try to contribute the most pre-tax dollars they can (up to the annual limit) to their HSA. Since high deductible medical plans usually have lower premiums, employees can put the money they save into their HSA. The tax advantages of an HSA vary by state, but dollars put into an HSA can help employees lower their taxable income.

- Invest a portion of the funds. HSAs give employees an opportunity to invest in mutual funds. This is a great way to build a nest egg for health care expenses in the future. Just remember investing comes with risk. Always speak with a financial advisor before investing.

- If you also have an HSA-compatible health care FSA (this FSA is different from a standard health care FSA — see below), don’t spend HSA funds on health care expenses unless necessary. Instead, use your FSA and keep the money in your HSA so it continues to grow.

- Don’t contribute to an HSA if:

- You are claimed as a dependent on some’s tax return.

- You are enrolled in Medicare.

- Have non-high deductible health care coverage, such as a standard health care FSA or an HMO plan without a high deductible. This applies to you even if your non-deductible health care coverage is through a spouse or domestic partner.

Learn more about HSA contribution rules at www.irs.gov/pub/irs-pdf/p969.pdf.

Employees Are Looking for More Benefits

As we continue through the COVID-19 pandemic, we’re all realizing like never before the importance of taking care of our health. According to a 2021 Aflac report, nearly half of all U.S. employees signed up for new benefits at work. Most of those were life insurance, but also very popular were critical illness, hospital indemnity, telemedicine and mental health resources. This is evidence that we all want to feel more protected.

Even after the pandemic ends, the desire for greater protection is here to stay. That’s why now is a good time to revisit the benefits available to your employees. We can help you create a more competitive benefits package — at the right price — to keep current employees happy and attract new ones.

Recent Comments